US interest rate traders are making record bets that the US Fed will swiftly adopt a more dovish stance after Fed Chairman Powell's term ends in May 2026.

Trading volume in these bets hit a record on Monday and expanded further on Tuesday. Traders are betting that whoever Trump appoints to succeed Powell will lead the Fed to cut interest rates almost immediately—the first Fed policy meeting under the new chair will be held in June 2026.

Over the past few months, Trump has been pressuring Powell to lower borrowing costs, even though Fed officials have signaled that they plan to stay on hold for now and closely monitor how Trump's tariff policies will ripple through the economy and affect inflation. The market widely expects the Fed to keep interest rates unchanged on Wednesday, and given the risk that tariffs could push up CPI, Fed officials in the dot plot may lower their forecasts for the extent of interest rate cuts this year.

These futures bets have been accumulating in markets linked to the Secured Overnight Financing Rate (SOFR), where the futures contracts closely track the Fed's interest rate policy outlook. The momentum behind these bets has been building since Trump said this month that he would nominate Powell's successor "soon."

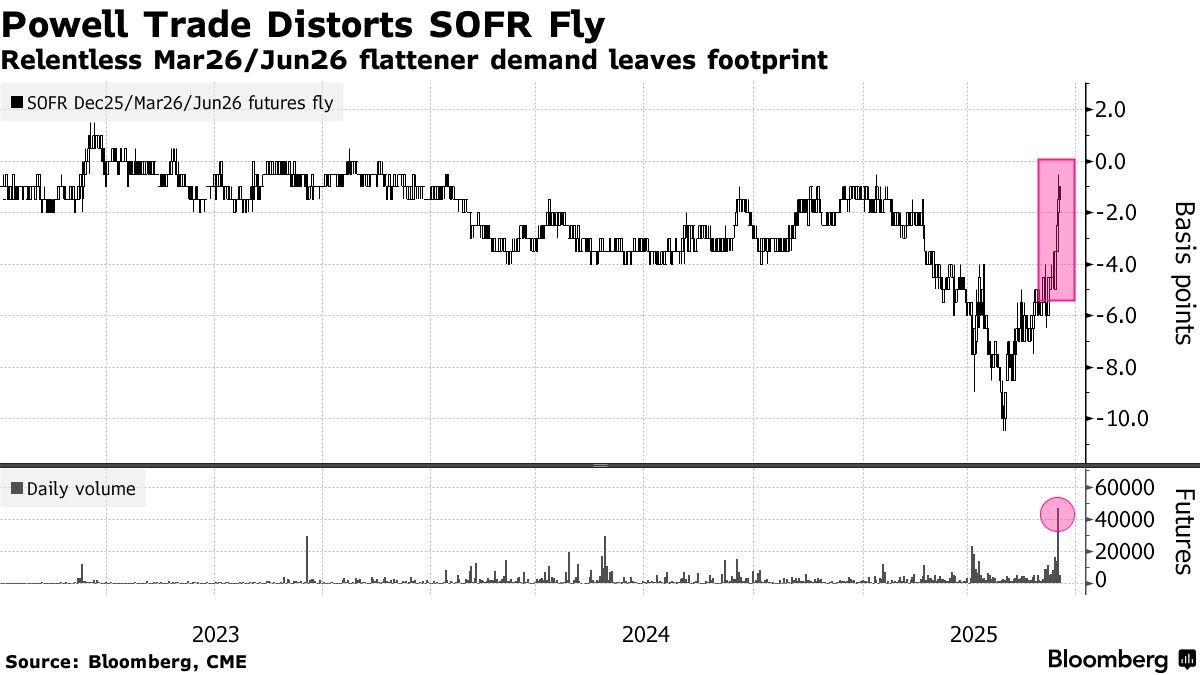

Data show that the bets on these interest rate futures involve selling SOFR contracts maturing in March 2026 while buying contracts maturing in June 2026—this is equivalent to a three-month spread trade and is causing chaos in futures contracts covering the first half of next year.

Heavy selling of the March contracts has led to an unusually large drop in their pricing relative to contracts with other maturity dates, particularly those maturing in December 2025 and June 2026. As a result, the relative spread around the March 2026 futures has surged to its highest level since January.

Trading volume in these futures positions hit a record of 108,649 contracts on Monday, equivalent to about $2.7 million in risk per basis point. The open interest in the March 2026 and June 2026 futures has reached the highest level in the current policy cycle, partly due to demand for this trade. Most of the trading in these contracts is done anonymously, making it difficult to identify the institutions involved and the specifics of the trades.

Will the next Fed chair pivot sharply dovish?

"Trump may choose a replacement who is clearly more inclined towards easier monetary policy, although this may make it harder for his preferred candidate to get through the congressional approval process," Steven Barrow, head of G-10 strategy at Standard Chartered, wrote in a report.

Analysts such as Will Denyer, an economist at Gavekal Research, have mentioned the potential risks associated with this development. Denyer pointed out that Trump's early nomination could lead investors to pay attention to the remarks of the "shadow" Fed Chairman and the signals sent by Powell simultaneously for nearly a year.

Denyer stated, "This discordant voice may once again undermine market confidence in US policy-making."

It should be clarified that monetary policy is formulated by the Federal Open Market Committee (FOMC), which consists of US Fed officials. The Chairman cannot unilaterally set policy interest rates.

The US Fed will announce its interest rate decision for June at 2 a.m. Beijing time on Thursday. Currently, the market's main focus is on the Fed officials' dot plot forecasts. It is expected that the latest forecasts from participating Fed officials will show only one 25-basis-point interest rate cut in 2025. In the previous round of economic forecasts released in March, the median forecast was for two 25-basis-point interest rate cuts by the end of the year.

In the interest rate market, traders are pricing in expectations for approximately 43 basis points of interest rate cuts by the FOMC by the end of the year, with the first cut potentially landing as early as September.

It is worth mentioning that currently, the market expects the US Fed's interest rate cuts from now until the end of 2026 to far exceed those of any other G10 central bank, which may further exacerbate the downward pressure on the US dollar.